Business Rates and Our Services

Tuesday 22nd August, 2023 by Host & Stay

What are Holiday Let Business Rates?

Business rates are charges that help pay for local services. These charges apply to properties that are used for business purposes only, which includes holiday rental properties. If you are offering your holiday rental for short stays and are renting it out for short periods, you will need to pay business rates if the rental income exceeds a specific limit. The exact limit varies depending on the location in the UK.

Changes to Business Rates on Holiday Lets

The UK Government is currently in consultation on several points relating to properties under the classification of Furnished Holiday Let’s/Short Term Accommodation/Self-Catering Accommodation.

One of the most important parts of this policy will be how the UK Government define a pre-existing holiday let, and we understand that this is now very likely to be classified on whether the property is registered for Business Rates as ‘Self-catering and holiday let accommodation’. Due to this, we are strongly advising our owners to register for Business Rates as soon as possible to ensure that they are in the best possible position when these changes are announced and implemented. It is also expected that properties will need to meet the minimum compliance requirements currently in place in Scotland, so it is more important than ever to ensure that your property is fully compliant.

If you are not fully aware of this consultation, please find below a number of useful articles that will bring you up to speed:

Register for Business Rates under the Self – Catering accommodation rules

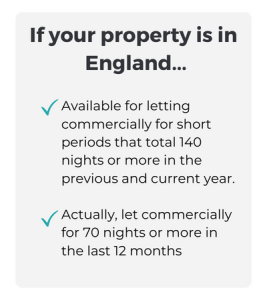

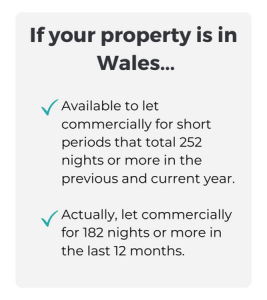

The VOA (Valuation Office Agency) has recently made changes to the criteria for a property used as a Furnished Holiday Let/Self-Catering Accommodation. To continue to be eligible for business rates from 1 April 2023, your property must be:

If you haven’t done so already, we encourage you to apply to the VOA and register your property for business rates as soon as possible. We believe this will be the baseline criteria for any use changes currently being consulted by the government.

You can apply to have your property moved from Council Tax to Business Rates by completing and submitting this form to the VOA: VO 6048

If you have only recently started to let your property as a Furnished Holiday Let, we advise applying as soon as you hit the 70-night letting threshold in England or the 182-night threshold in Wales.

Our Revenue Management team will work with you on a flexible booking strategy designed to drive booking performance that reaches those thresholds as quickly as possible from the point of go-live.

Once your property has been successfully moved to Business Rates, you will be required to complete and submit this this form: VO 6048 Short Form on an annual basis to keep your information up to date.

Our Annual (VOA) Business Rates Completion Service

Let us take the hassle out of your VOA submissions with our Annual VOA Completion Service…

What’s the difference between Holiday Let Business Rates and Council Tax?

Council tax is charged to both residential and domestic properties, it can also apply to holiday homes that are used mainly for personal use. Whereas business rates are charged to properties that are more commercial and are available to let for 140 days (in the UK) or 252 (in Wales) or more in a calender year.

Small Business Rates Relief

Some properties may be able to claim for small business rates relief, which may bring the costs of your business rates down.

You can contact your Local Council to apply for small business rates relief.

How to Calculate Business Rates for a Holiday Let Property

Start by taking the rateable value assigned to your property and then utilize the small business multiplier established by the government. This will allow you to estimate the amount you’ll be required to pay in business rates.

Your holiday let’s rateable value is an amount calculated by the Valuation Office Agency (VOA), based on your property’s rental value.

Calculate your property's rates here